Payment Processing Fundamentals Explained

Table of Contents6 Simple Techniques For Merchant AccountGetting The Payment Solutions To WorkPayment Processor Things To Know Before You BuyPayment Processor Things To Know Before You BuyCard Processing for BeginnersWhat Does Merchant Account Mean?See This Report on Online Payment Systems

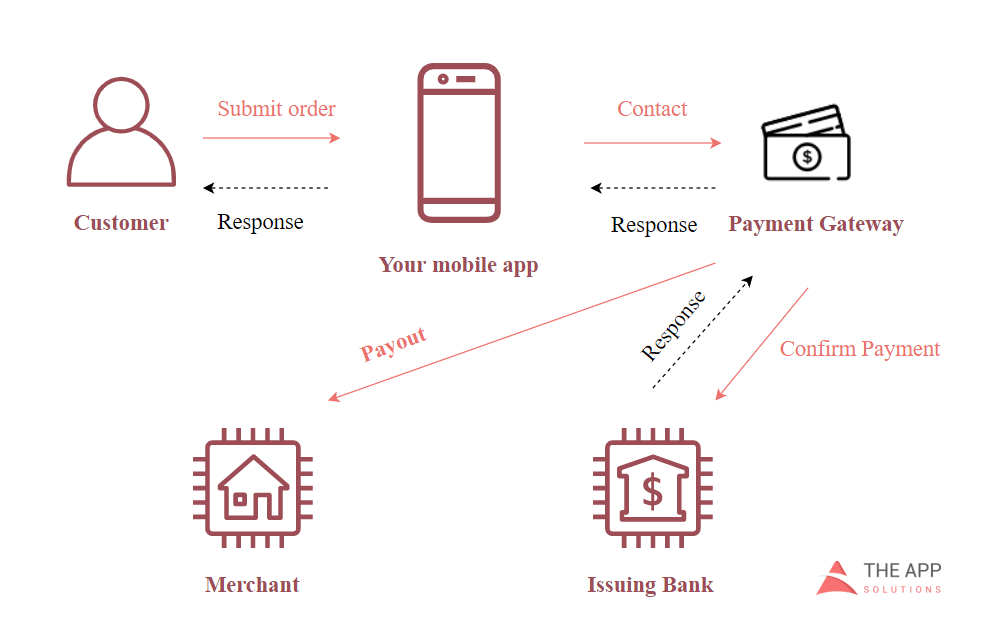

Transaction standing is returned to the payment entrance, after that passed to the internet site. A consumer obtains a message with the transaction status (accepted or rejected) through a payment system interface.

Now we are relocating closer to settlement gateways in their selection. To incorporate a repayment system into your web site, you will have to adhere to multiple actions. Repayment portal integration Usually, there are 4 primary methods to integrate a repayment portal. Every one of them vary by 2 major elements: whether you should be in conformity with any kind of economic regulation (PCI DSS), as well as the level of customer experience concerning the checkout and also repayment procedure.

The Only Guide for Payment Solutions

What is PCI DSS conformity and also when do you need it? In instance you just require a settlement portal service as well as do not plan to shop or process debt card information, you may miss this area, because all the handling as well as regulative concern will certainly be performed by your portal or settlement service provider.

is a required component for handling card payments. This safety criterion was created in 2004 by the 4 greatest card associations: Visa, Master, Card, American Express, and also Discover. To end up being PCI certified, you will certainly have to complete 5 actions:. There are four degrees of compliance that are determined by the number of risk-free transactions your organization has actually completed.

SAQ is a collection of requirements and sub-requirements. AOC is a kind of test you take after reading the demands. There are 9 types of AOC for different companies.

9 Easy Facts About Merchant Account Explained

Given this information, we're going to consider the existing combination choices as well as discuss the benefits and drawbacks of each. We'll likewise concentrate on whether you should adhere to PCI DSS in each case as we discuss what combination techniques fit various kinds of businesses. Hosted portal A hosted settlement portal acts as a 3rd party.

Essentially, that's the instance when a client is redirected to a payment gateway internet page to type in their credit card number. Held settlement gateway work scheme of an organized settlement gateway are that all payment handling is taken by the service supplier.

Utilizing a held gateway needs no PCI conformity and also uses pretty easy integration. Customers might not rely on third-party repayment systems.

All About Online Payment Systems

Pay, Pal Checkout recommends combination in the form of a Smart Payment Button. Basically, it's an item of HTML code that applies a Pay, Pal switch on your checkout page. It conjures up the Pay, Buddy REST API calls to validate, accumulate, and send out repayment details with a gateway, whenever a user causes the switch.

Straight Post approach Straight Post is a combination approach that enables click here to find out more a client to shop without leaving your web site, as you do not have to obtain PCI compliance. Straight Blog post thinks that the purchase's data will certainly be posted to the settlement portal after a client clicks a "purchase" switch. The data promptly reaches the portal and also processor without being kept on your own web server - online payment systems.

Unknown Facts About Payment Processing

Research study the prices Repayment handling is intricate, as it includes numerous financial organizations or companies. Like any solution, a payment gateway calls for a cost for using third-party devices to process as well as license the deal.

Every repayment option copyright has its very own regards to usage as well as charges. Normally, you will have the adhering to charge types: gateway setup fee, month-to-month portal charge, merchant account setup, and also a cost for each purchase processed. Check out all the rates paperwork to stay clear of surprise charges or additional costs. Check purchase restrictions for a provided company While charges and installment fees are unpreventable, there is one thing that may establish whether you can deal with a specific supplier.

Online Payment Systems Things To Know Before You Get This

This is primarily a prebuilt entrance that can be personalized and also branded as your own. Below are some well-known white tag options made for vendors: An incorporated gateway can be a committed resource of profits, as vendors that get all the needed conformity end up being settlement company themselves. This means your organization can process repayments for other merchants for a cost.

are that you have complete control over the purchases at your internet site. You can personalize your settlement system as you desire, and customize it to your organization needs. In instance of a white-label solution, the payment entrance is your top quality innovation. normally are all concerning maintaining the facilities of your settlement system as my response well as the associated expenditures.

Right here are some points to consider prior to determining on a provider. Research study the pricing Repayment handling is complex, as it consists of a number of banks or companies. Like any solution, a settlement portal needs a fee for using third-party tools to procedure as well as license the deal. Every celebration that takes part in repayment verification/authorization or handling costs costs.

The Facts About Payment Processing Revealed

Every settlement solution provider has its very own terms of use and costs. Generally, you will have the following cost types: portal configuration cost, regular monthly entrance cost, merchant account arrangement, and also a fee for each deal processed.